Actual Cash Flow Returns.

We cater for the investor who has a receivables-backed mandate, who is frustrated by the private credit alternatives, and who is looking for a suitably risk managed offering that provides realised and stable risk-adjusted returns on a revolving basis. We do this by identifying, implementing and growing assets that are impactful, sustainable and inherently low risk in nature.

The Experienced Risk-Taker

Ziada Credit Solutions provides support to the asset manager with a private credit investment mandate, dissatisfied with the current alternative investment ecosystem, frustrated with the lack of transparency, spurious asset performance, and upfront and inflated fees. Ziada Credit Solutions offers participation in receivables-backed facilities that provide realised and stable risk-adjusted returns on a revolving basis.

A Growing Asset Class

Private credit investment in accounts receivables remains particularly attractive to investors as it offers:

- consistent short-term returns

- competitive yields

- modest levels of risk

compared to more commonplace investments and markets, while the underlying transaction processes are technology-enabled (PrimeRevenue).

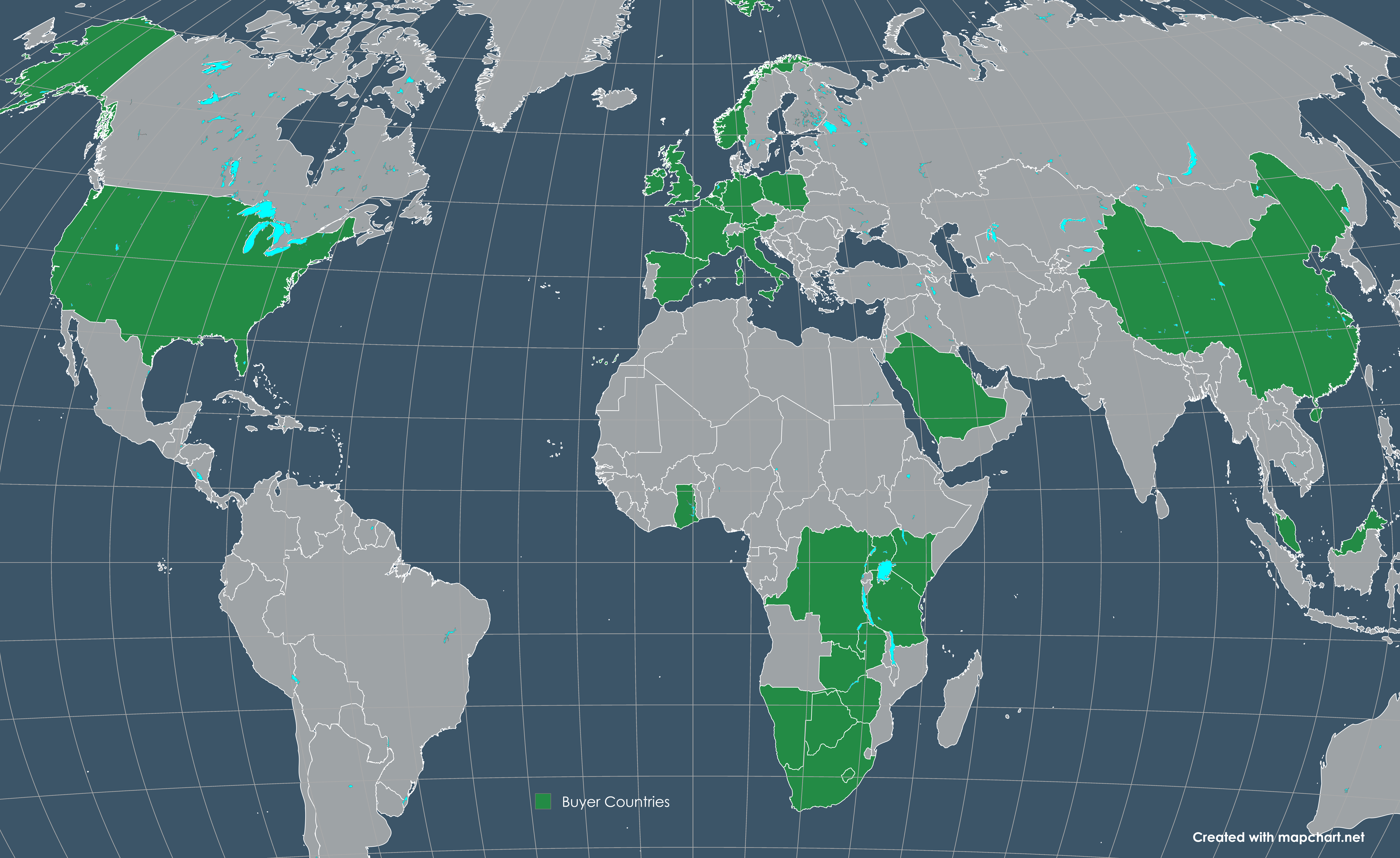

We firmly believe there is very significant capacity for the asset class to expand, particularly in emerging markets. Ziada is a leader in originating, structuring, and actively risk managing portfolios of receivables on an ongoing basis, driving growth and stability for our investors.

Our Numbers

NUMERIC OVERVIEW

Counterparties faced

320 +

Number of Invoices processed

24 000 +

Value of Invoices purchased

USD 189 mn

Value of Promissory Notes processed

USD 125 mn

Value of LC's discounted

USD 30 mn

SCF Facilities granted

USD 40 mn

SRF Facilities granted

USD 48 mn

NUMERIC OVERVIEW

Counterparties faced

320 +

Number of Invoices processed

24 000 +

Value of Invoices purchased

USD 189 mn

Value of Promissory Notes processed

USD 125 mn

Value of LC's discounted

USD 30 mn

SCF Facilities granted

USD 40 mn

SRF Facilities granted

USD 48 mn